In the 2020s, contactless money transfers have become the norm, and applications for mobile payments are simply a must-have for efficiency. Among such applications, the most recognizable is, perhaps, Zelle which has been engaging a lot of customers due to its connection with key banks and instant payments.

This article will be a review of the Zelle app, which will aim at assessing pros and cons of the app and the general user experience as a basis for choosing the convenient app for banking operations.

Zelle – American Mobile Payment Service

Now an independent mobile payment startup that operates under the First National Platform, Zelle was initially developed in 2017 with the participation of major US banks, such as Bank of America, JPMorgan Chase, and Wells Fargo. One major advantage that it has over other products is the fact that it works smoothly alongside traditional bank accounts, such that there is no need for using a different account or wallet. It is easy to transfer and receive money directly from the bank accounts without using any other means, or even through the e-mail address and phone number.

Pros of using the Zelle App

- Speed and Convenience

Having the ability to send money quickly is one of the most noticeable things about the Zelle app. It is also considered to be almost instant as long as both the sender, as well as the recipient, banks are part of the Zelle service and unlike other P2P payment applications that can take up to three business days to process the transactions. This feature makes the use convenient to be used in cases where you need to make an instant payment and also for splitting the bills, or for making payments to friends and families or anyone in real-time.

- No Fees

In leveraging a payment platform, we must acknowledge that Zelle charges its users no fees in money transfer for both sending and receiving. This is a better outcome compared to some of the other services in the market that charge transaction fees, particularly on instant transfers. Thus, the fact that it does not attract any fees increases the chances of its popularity with users who often pay for money transfers.

- Bank Integration

This is because organizations can access Zelle through the leading financial institutions where they have an account. The reality is that users don’t need to create a unique account in the app for participating in the program or save money on the account balance. No, Zelle shares a more intimate partnership with their current banks because it navigates their existing bank apps making it easier for users to utilize. It also helps to note that with integration, users’ money is safe from bank security as well as with their funds.

- Accessibility

Notably, users easily download the Zelle app since it is compatible with most U. S. banks and credit unions. While some banks have not adopted this program, a user is still able to link the debit card to the Zelle app directly. This broad accessibility will see that as many persons as possible are able to access the service.

Cons associated with the use of the Zelle App

- Limited International Transfers

On its downside, Zelle lacks the flexibility of making cross-border transfers and only allows transactions for domestic use in the United States only. While there are some other applications which provide the service for transferring money across international boundaries, Zelle can only be utilized in transferring money between two bank accounts, both of which are located in the United States. This is definitely a limitation that might be tall order to customers who for example wish to send money outside the country.

- No Purchase Protection

It is important to note that, at this point in time, Zelle does not have the purchase protection feature for consumer products and services. In cases where a user transfers money to another individual to purchase a particular product or service but is not supplied the money, Zelle cannot help him or her recover the cash. Due to the lack of buyer protection Zelle is not as safe for using with strangers or for purchasing goods via the internet.

- Dependence on Bank Participation

On a similar note, despite Zelle having backing from many of the chief banking institutions, the service is not available with banks in the non-supporting list. People who have banks that are not on Zelle may potentially rely on the single Zelle interface, which is not as smoothly incorporated into the user’s bank application as the official method.

- Potential for Scams

As such, because of the rate with which it is processed, and most of all since there is no provision for reversal of transactions once done, Zelle has become rather easy for scams. The movement back and forwarding system can be manipulated in that any user who transacts with the scammer will send money for fake products or services. Users need to ensure that they extend monetary transactions only to contacts that are familiar and can be relied on.

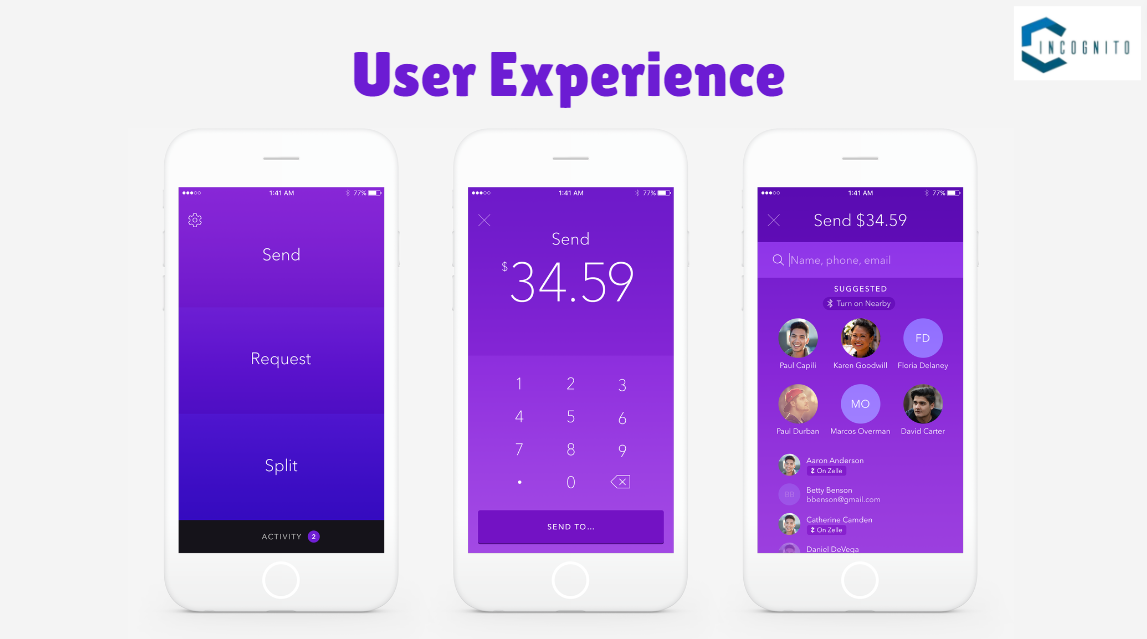

User Experience

- User Interface and Usability

It is also essential to note that the Zelle app has one of the most straightforward ways of using the application by providing efficient and convenient ways of completing a transaction. Linking a bank account or debit card along with verifying the contact information and then start transferring or requesting for money is the way how the setting up of the app takes place. The layout of the app is rather simple and this makes it possible for first time app users, or even non-technologically inclined people, to be able to use the app efficiently.

- Transaction Process

Using the Zelle application, it is fairly easy to transfer money from one account to another. Concerning the features of the applications, it just required a recipient’s email address or phone number, the amount of money to transfer, and an additional message. The money reaches the respective recipient and s/he gets notified and can instantly withdraw the money if their bank is enabled by Zelle. For those other banks that did not partake in this service, recipients can follow instructions to link up their debit card then claim the money.

- Security Features

Zelle banks and providers rely on multi-factor authentication, encryption, and fraud monitoring measures of the respective banks. Further, Zelle deals with peer-to-peer transactions whereby bank accounts are connected; thus, transactions are secured by the security measures in place in banks. Nevertheless, users are still advised to protect themselves from installing fake apps and be wary of disclosing personal data on live chats with unfamiliar contacts.

- Customer Support

Zelle does not offer its own customer support, instead, customers who use the app, can get in touch with the customer support of the specific bank that the app is partnered with. This can be rather beneficial for the users as they can address the problems with support options they are already familiar with. However, certain users especially on the B2C platform have also noted that it’s hard to resolve fraud or any wrong transaction that has been made thus the need to practice user awareness.

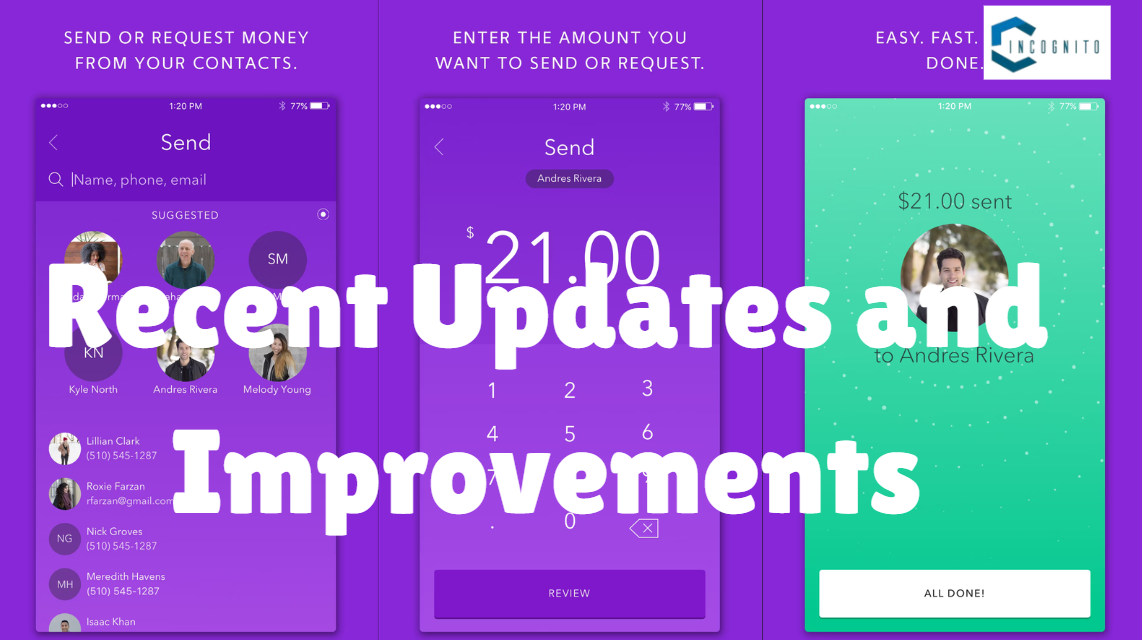

Recent Updates and Improvements

Additional changes in Zelle have been made in 2024 all aimed to improve the user experience and enhance security. These include:

- Enhanced Fraud Detection: Zelle additionally has stronger fraud detection parameters that help the application to counter fraudulent transactions. This enhancement is to enhance securing of the system that will act as a measure to minimize scams and unauthorized transfers.

- User Education Initiatives: Zelle has gone a step further to ensure that users engage in secure transactions by using the app by undertaking awareness creation. Such initiatives include simple measures that involve giving users tips on how they can avoid the scams, and this will help them be more safe.

- Improved Customer Support: During the creation of the app, it collaborated with partner banks to organize the flow of problems that customers may face in the process of using the application effectively. This improvement is one of the many intended steps towards general execution of the average user experience.

- Expanded Bank Participation: Zelle, is yet, actively adding more banks and credit unions to its service, thereby, increasing its coverage area hence the number of its users in the United States Of America.

Conclusion

The Zelle app will continue to survive the competition in 2024, as it includes substantial advantages which are speed, convenience, and especially, no fees for the transactions. The fact that it is integrated with the major banks means that the service is user-friendly to the extent, and the fact that the service is easily accessible makes it possible for users to consider it. Though, restrictions like no cross-board transfer, no purchase protection, and issues related to scams are a warning sign.

Overall, if a user is looking for a quick, efficient, and wallet friendly means of transferring money from one domestic bank to the other then the Zelle would be perfect for that. Using Zelle can, therefore, be regarded as a secure way of carrying out transactions since it complies with industry standards and norms and has its weakness when applied and thus enables users to meet their financial needs as required. Given the fact that the common usage of digital payment is progressive, it may be expected that, going forward, more updates that would bolster the effectiveness and ease of use of Zelle would be made.

Leave a Reply